Executive Summary

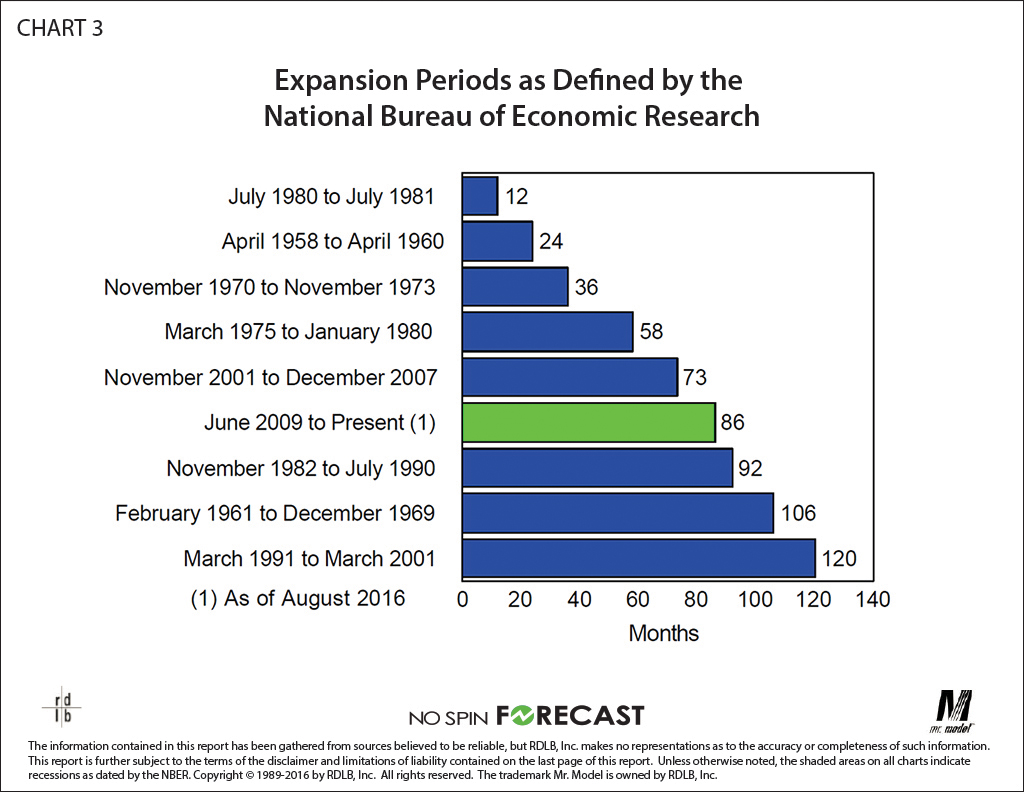

This report explores the relationship of the business cycle to the performance of the stock market. The question we want to answer is, can stock market investors use this relationship to their advantage? Specifically, can an investor improve performance by adjusting equity exposure based on cues from the business cycle? We find that the answer to these two questions is yes, as long as the investor knows what clues to look for, and has the discipline to act.

Stock market crashes, corrections and bears cause significant damage to investors who are unprepared to deal with them effectively. But investors who are able to tell the difference between market declines that are linked to a business cycle turning point, and those that are not, have a distinct advantage in the market.

In Stocks For The Long Run, Wharton Professor Jeremy Siegel shows that switching out of stocks and into Treasury bills before the onset of recessions, yields a performance bonus of more than 4% over a simple buy-and-hold strategy. And being in Treasury bills during the worst market declines has the additional benefit of reducing overall portfolio volatility.

Is there a way to know – ahead of time – that getting out of the way of a market decline is the right move? We find that the answer depends on whether or not the decline is associated with a business cycle turning point.

It is almost as hard to forecast the business cycle using the stock market, as it is hard to forecast the stock market using the business cycle. The two are connected, but the lines of causality are blurred, at best. Going through each of the market events that took place during the longest economic expansions will give us important clues about the nature of the connection.

Read the full special report. Click here >>