I recently had a query from a client about what happens to monetary policy when there is a changing of the guard at the Federal Reserve. My reply was “nothing much”. He pressed for more details, and I sent him the following comments.

The modern era of macroeconomic management dates from the passage of the Employment Act of 1946, starting the practice of using fiscal and monetary policy to help regulate aggregate economic activity so as to help produce conditions of full employment and stable prices. Monetary policy is carried out by the Federal Reserve, and one of the principal instruments it uses is the Federal Funds Rate.

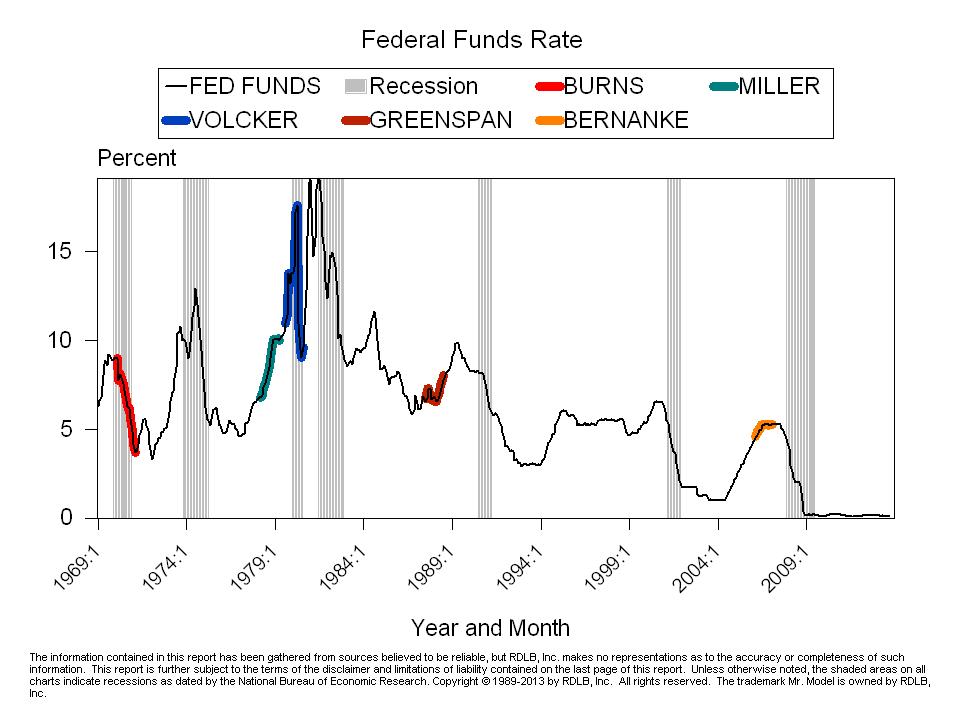

William M. Martin was Chairman of the Federal Reserve when the Federal Funds Rate was implemented in 1954. The chart you see below begins in 1969 because his successor, Arthur Burns, took over in February of 1970.

On the chart, the periods you see highlighted in various colors start in the month each of the persons who occupied the position took over and the 12 months immediately following that event. And, as you can see from those highlights, not much happened in those first 12 months relative to what had been going on prior to the time they assumed the post.

Burns continued the efforts of Martin to respond to the recession of 1969. Miller continued the policy of Burns to counter the outbreak of inflation that had begun shortly after the end of the recession in 1975. Volcker continued Miller’s policy, and then reversed course, at least momentarily, after the recession of 1980. Greenspan continued what Volcker had started, namely the beginning of what turned out to be the tightening that preceded the recession of 1990. Bernanke, who took office in February of 2006, continued the plan that had been started by Greenspan of raising the Federal Funds rate in steady and predictable increments into early 2007.

To the extent one can rely on historical patterns, it would seem that the accession of Dr. Yellen to the chair would not portend an immediate change in policy. The current stance of the Federal Reserve is to continue to provide support to the economy, the financial system, and the financial markets for as long as necessary in a manner consistent with the employment and inflation targets set out in the minutes of the Federal Open Market Committee.

When we will start to add a new colored segment to this chart is still a matter of speculation, as we don’t know when exactly the change in administrations will take place. But once we do, we will send you periodic updates of this chart.